Fitch Ratings once again awarded Las Vegas Sands (NYSE: LVS) an investment-grade credit rating. The research group mentioned Sands' two operating markets, Macau's recovery and Singapore's general strength.

Based on those indicators, Fitch noted that LVS used the ratings agency's "upgrade sensitivities" to drive leverage. About eight months after Standard & Poor's (S&P) became the first of the three main credit research agencies to restore the gambling company's investment-grade rating, Sands has now been given a "BBB-" rating with a "stable" outlook.

"Fitch believes the pace of recent growth in Macau should allow LVS to continue to remain at investment grade metrics given the company’s strong position in the premium mass market, along with positive free cash flow generation and strong liquidity,” noted the research firm.

The six concessionaires in Macau, including Sands China, earned $2.4 billion last month, a 67% increase from the previous year. With five casino hotels, Sands China is the biggest operator in the Special Administrative Region (SAR).

Large Projects Can Be Funded by Sands

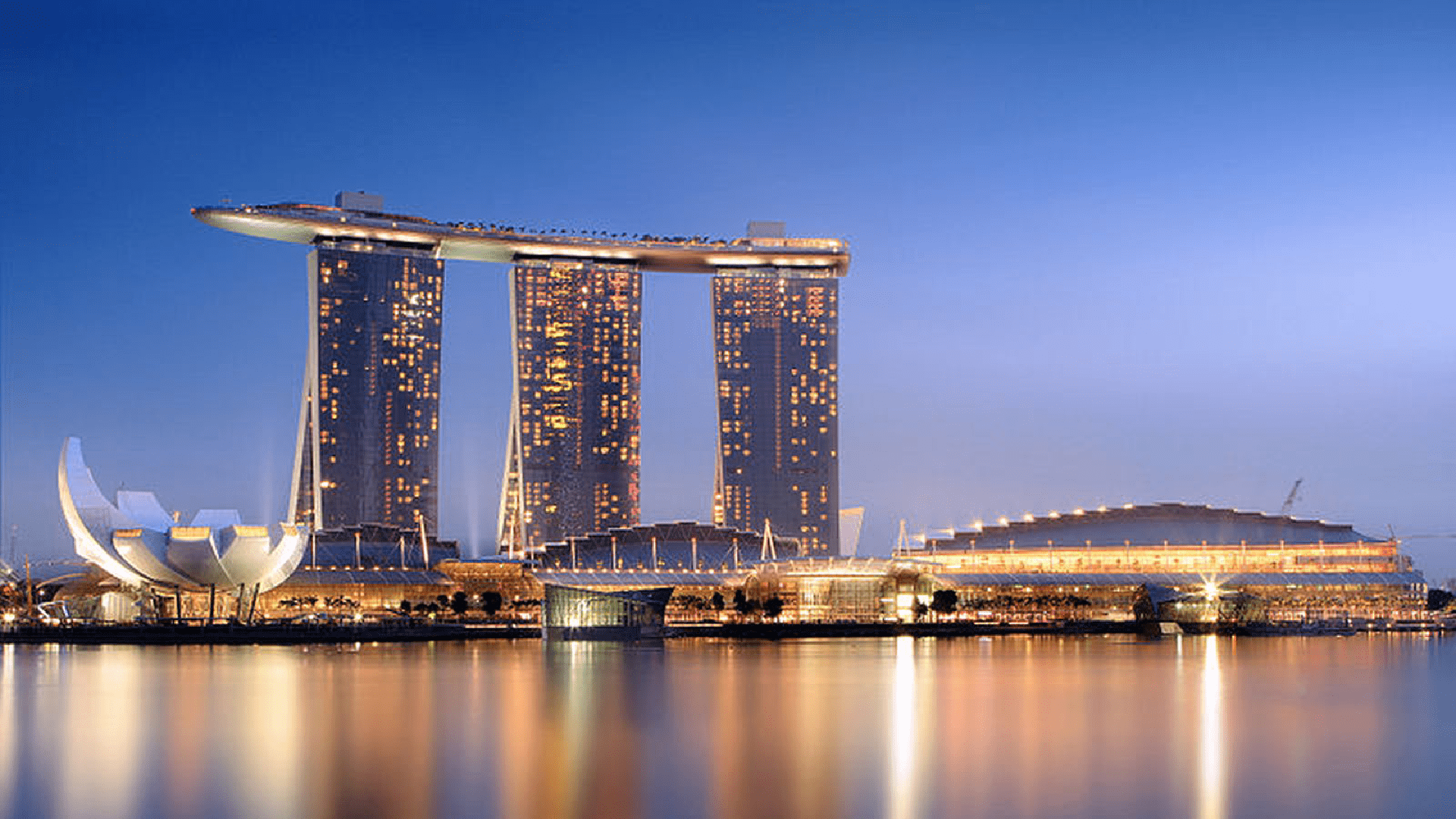

In the fourth quarter, LVS invested $325 million in improving Marina Bay Sands and its Macau properties, among other costs. According to Fitch, the operator can manage more extensive expenditures, such as a potential integrated resort in New York, without jeopardizing its financial stability.

“LVS has a potentially heavy capital program, especially if it wins a New York City license, but Fitch believes the company is able to meet this funding without materially affecting the balance sheet,” according to the ratings agency. “The rating also reflects potential weakness in the China economy, regulatory changes, and an increasingly competitive environment in Macao from new openings and expanded facilities.”

Sands had access to $4.44 billion on a revolving credit facility and $5.11 billion in cash on hand at the end of the fourth quarter. By the end of 2023, the gambling company owed $14.01 billion. Its closest debt maturity is August, when $1.75 billion in unsecured notes are due.

“Fitch believes LVS is willing to manage its balance sheet in a manner consistent with investment grade ratings, and the company has a solid track record of publicly articulating its leverage policy and adhering to prudent balance-sheet management,” added the research firm. “Management has stated a gross target debt ratio of 2.0x-3.0x before the impact of development projects.”

Singapore and Macau Can See Further Development

While the premium mass segment is dominating in Singapore, Marina Bay Sands, one of the most lucrative integrated resorts in the world, is already setting records among mass market bettors.

The fact that, despite the fact that casinos in Macau and Singapore are doing well, Chinese travel to these areas is still below pre-coronavirus pandemic levels is crucial to the prognosis for Sands' credit profile and stock. That suggests that there is more space for development.

“Despite the rapid growth in gaming revenues, visitation and airline capacity remain below 2019 levels, and the rebound in those metrics should provide another source of further revenue growth over the near term,” concluded Fitch. “In addition, capital improvements, particularly at The Londoner, should further drive long-term growth for LVS.”

Exclusive Casino Bonuses

Oshi

- Home to more than 70+ gaming providers

- Received the AskGamblers Certificate of Trust

- An extensive list of restricted games with bonus funds

Play with

Canadian dollars, Chinese yuan, Euros, Norwegian kroner, US dollars, Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Dogecoin, Tether, Brazilian reals, Ripple, TRON, Russian rubles, Japanese yen, Polish zlotys, Indian rupees, ADA, Binance Coin,Wagering Requirements

-Minimum Deposit

-150% up to €500

& 200 FS

Deposits

Other Payment Methods

Withdrawals

New players only. T&Cs apply. 18+

Intense Casino

- Mobile friendly design

- The Curacao licensed site

- Limited live chat hours

Play with

Wagering Requirements

-Minimum Deposit

-Welcome offer

up to €888

Deposits

Withdrawals

Other Payment Methods

New players only. T&Cs apply. 18+

Betition

- Offers great welcome bonuses and promos for sports

- Home to leading software providers

- Limited live chat hours 08:00 - 00:00 CET

Play with

Canadian dollars, Chilean pesos, Euros, Norwegian kroner, British pounds sterling, US dollars,Wagering Requirements

Not StatedMinimum Deposit

€ 10Welcome offer 100%

up to € 150 + 150 Spins

Deposits

Withdrawals

Other Payment Methods

New customers only. Minimum deposit: First deposit € 10. Max. Bonus: € 150. Offer applies to the first deposit. Offer only applies to new players. The spins are awarded as follows: 50 spins on book of dead plus a 100% bonus on your first deposit up to € 150. You will receive an additional 50 spins on book of dead when you make your deposit on the second day of at least € 20 and another 50 spins when you make a deposit on the third day (at least € 20). Winnings from games that require a deposit must be wagered 35 times. A bonus that requires a deposit must be wagered 35 times. Terms and conditions apply, see full terms: Bonus Policy 18+ T&Cs and wagering requirements apply.